bUSINESS fINANCING sERVICES

- We’ve partnered with a $2.2 billion direct lender and tech-enabled loan marketplace to offer affordable and comprehensive financing for a variety of business needs.

- Nationwide lending and most business types are eligible even those turned down by other lenders due to credit issues, limited collateral, or other financing barriers.

- Choose from multiple financing programs including SBA 7(a), SBA 504, SBA Express, Conventional Business Term Financing, and Commercial Real Estate Financing.

fast capital

We offer multiple financing options for businesses including Term Loans, SBA Loans, Advances, Credit Lines, and more! We can even consider borrowers turned down by other lenders due to low credit or other financing barriers.

Funds can be used for most business purposes such as to buy equipment or inventory, for working capital, or to consolidate debt or merchant cash advances.

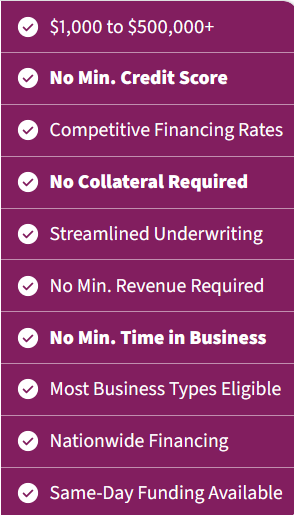

$1,000 to $500,000+ financing sizes

• Up to 10-year financing terms

available.

• No minimum credit score required

• No set credit score minimum

• Competitive financing rates with the option to choose from multiple offers and product types

• No minimum revenue required

• 100%financing on equipment

purchases

This does not apply for startups, in most cases a down payment would be required on a purchase for a startup.

• No minimum time in business (startups considered for stronger credit profiles with compensating factors)

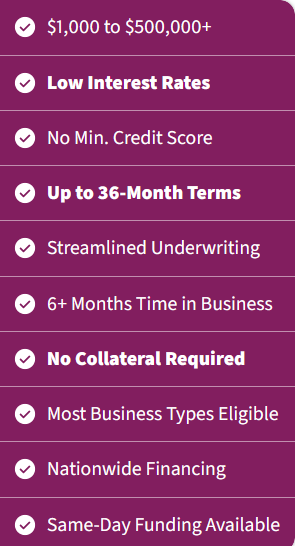

CREDIT LINE

Are you seeking flexible access to capital, where you pay only for the funds you need? A revolving business line of credit operates like a credit card, usually offering a higher credit limit and lower interest rate, and you pay interest and fees solely on the funds you utilize.

You can pay off your balance at any time without incurring penalties and repeatedly draw funds for expansion, emergencies, or any unforeseen business expenses—all through a convenient online portal.

BUSINESS FINANCING

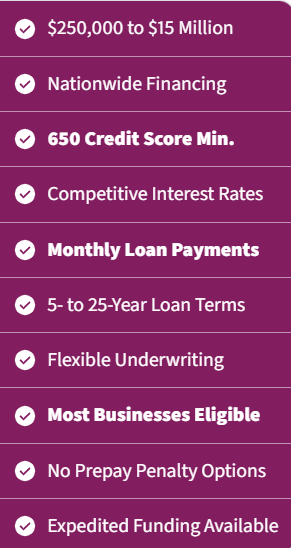

Business owners can access flexible Conventional Loans or preferred SBA Financing for a variety of business purposes.

to purchase or construct commercial real estate, to buy or start a business

for large amounts of working capital, to open a new location, or to consolidate debt or merchant cash advances.

We can even consider borrowers turned down by other lenders due to credit issues, limited collateral, or other financing barriers.

Cannabis financing also available!

A One Stop Shop For All

Your Financing Needs!

EQUIPMENT

We are partners with one of the nation’s top equipment lenders and our customized term and payment options match your business’s cash-flow cycle.

Our innovative loan portal and live personal support enable us to issue financing approvals in hours, and fund in less than a day.

Most equipment and businesses are eligible, and you can count on the most competitive terms and a tailored equipment financing structure that works for you.

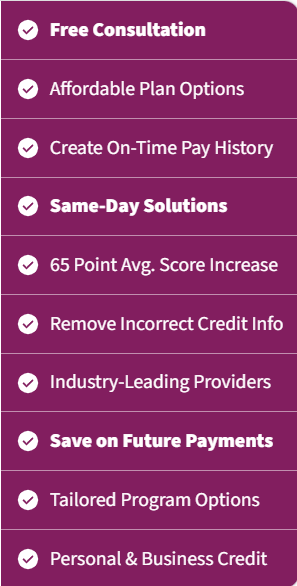

CREDIT BUILDER

Even if you have no or low credit, you may still be eligible to prequalify for financing without impacting your credit through our flexible programs. If financing eligibility remains a challenge, our advisors can assist you in selecting from various Credit Builder products, such as the Credit Builder Loan, Credit Builder Card, Bill and Rent Reporting, and Credit Repair.

With ongoing credit score monitoring, you’ll receive notifications about score improvements and when you’ve re-qualified for better financing terms.

FAQS

Listed here are the most commonly asked questions about who we are and how we operate. If you have a question that

is not found here, please do not hesitate to contact us and we will be happy to address it.